Both developed and developing, big and small economies, right across the world have over the last 5 years grown their security businesses at unprecedented rates. The same demand drivers apply, albeit having different levels of importance, leading edge technology is being used in all, and globalization of the supply side is providing a common front. So what if anything separates developed high penetration markets from the rapidly growing under-developed low penetration markets and what do we need to know to ensure that the long-term opportunities in both are carefully nurtured?

.jpg)

Three detailed multi-client studies published by i& i - Proplan within the last 12 months covering Central Europe, Western Europe and Asia have shown many similarities at the superficial level but when you get down to the detail, some distinct differences apply between these markets. The reasons behind these differences need to be understood in order to develop effective business and marketing plans. In order to do this we have used our Online Business Intelligence Service (OBIS)1) to join together the information from the three regions and analyse in a series of market sectors and segmentations across the different country markets. Many hundreds of comparisons could be made by OBIS but for the purpose here we have limited the analysis to four factors and reviewed across the combined IBC(s)2) business.

The electronic security market in these three regions is in different stages of development and

Figure 1 shows how we assess this characteristic. Western Europe is a developed market with a high level of penetration, with stable but relatively low levels of growth. Central Europe is a developing market with a medium level of penetration and relatively higher levels of growth, while China is a developing market with a low level of penetration and having by far the highest level of growth. One measure of future potential growth in any market is the relative level of penetration. In the case of China, penetration is only 6% of that achieved in Western Europe. Assuming that China will ultimately aspire to reach that level achieved in Western Europe then it has enormous potential to grow.

Figure 2 shows where the business is being won in the broad sector of construction activity.

In China, over 70% of all security business is installed in new buildings, which is not surprising given the importance of new construction in China. This is followed by Central Europe at 55% and the highly developed market of Western Europe at 37%. In the latter refurbishment and renovation and retrofit/replacement take 63% of the business and this favors those suppliers with a large heritage market. Furthermore, it opens up the opportunity to bring new products to market on the basis of delivering to existing satisfied clients. However, that is not the whole story. In China, with the high spend in new major infrastructure projects such as transport, it has opened up the opportunity to take a new approach to providing holistic solutions and integration, not only across the different types of electronic security, but also with other intelligent infrastructures in buildings and indeed the convergence with the business enterprise. China has yet to benefit much from the retrofit and replacement of security systems in existing buildings but this business will inevitably come and expand demand and this trend is already taking place.

In Figure 3 we have shown the value of business taken by the three types of electronic security systems, access control, CCTV/video and intruder alarms. From this it can be seen that intruder alarms, once the largest of the three systems by value in Western Europe, now only shares the joint top with CCTV/video. However in Central Europe it is a poor second to CCTV/video and in China it takes only 16% of the business. Clearly the replication from developed to developing markets does not work here. The market has moved forward and China has rejected the contribution that intruder could play in favor of the benefits that CCTV/video offers.

|

|

|

|

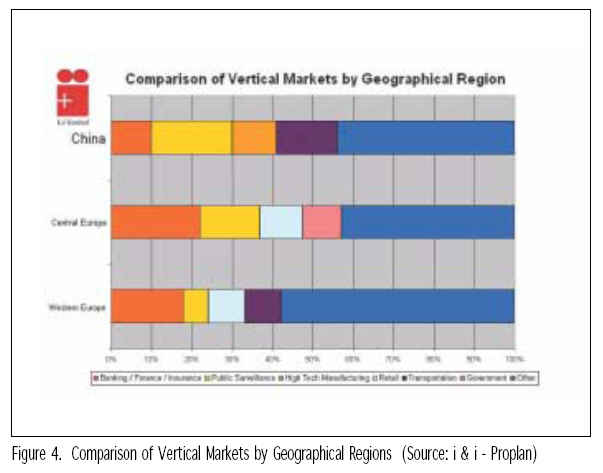

In Figure 4 we have shown across the three regions the proportion of business being carried out in the respective vertical markets but have on this occasion focused in on CCTV/video systems. In order to deliver a clear message, we have not shown all the 16 vertical markets available to us, but have taken for each region the top four shares by type of building/ end use. In China these are in order of size of share, public surveillance, transportation, banking finance/ offices and high-tech manufacturing. Banking finance and offices was by far the largest share in 2002, but major infrastructure projects in the Safe City Scheme and transport projects have brought these sectors to the front. In Central Europe the top four contribute the same percentage of business at 57% but here retail and government buildings replace high-tech and transportation. In the developed high penetration market of Western Europe, the top four shares only contribute 44%. Banking finance and offices take the lion’s share at 18% and this is likely to continue as its economy is based more on the information and services businesses than manufacturing. Retail takes the next largest share followed by transport. Public surveillance contributes only 6%, and yet in the U.K. it realized a 15% share. There are very good reasons for this which need to be understood for despite the fact that public surveillance appears to have reached its nadir in the U.K., it will grow rapidly in many other Western European countries in the next five years.

We have illustrated here that across the full spectrum of different stages of developed and developing markets the seemingly obvious relationships and consequences do not always apply and it is necessary to go down to the detail to unravel the cause and consequence.

What Sets China Apart?

There are a number of factors that set China apart from other developing markets. The first but no necessarily the most important is that it has its own booming security manufacturing industry and the world’s component giants have grasped the opportunity to help develop the market rapidly. The ground here is fertile to take on the advantage of new technology. This is because of the large infrastructure projects and the fact that end-users are demanding that players redefine their technologies and as a result product cycles are much faster.

The second is the fact that as our study “Security Systems -The China Market 2006-2011” forecasts China will become the largest market in the world when it overtakes North America in 2018 and will be double its size by 2030. In the last five years, growth of 29% per annum has been achieved and in CCTV/video surveillance, this has been well exceeded. Nevertheless, starting from its present position of being less than 25% of the size of the North America market, itself fast growing, this takes some believing. However, i & i - Proplan has been charting the performance of this market since 1994 and our reports show that it has far outstripped any other market of size during the last fifteen years. It is not just the growth or future potential that marks China out for special attention, it is the shear consistency of extra ordinary performance over the last 15 years that sets it up as the most attractive and consistent market in the world. When we carried out our first multi-client study on China in 1995, the best economic brains in the world declared that the current economic growth could not be sustained, but it actually went on to outperform.

Then in 2002 when we carried out the second edition of the study they advised that it could no longer defy gravity and growth would decline but it continued on at the same breathtaking pace and now in 2006 the experts say that economic growth will be sustained provided that the country remains politically stable. No one doubts this, or the important role that security will play in achieving it.

.jpg)

CCTV/Video Surveillance Market

The total electronic security systems market in 2006 was worth CNY13,248 million and of this the CCTV/video surveillance market has not only maintained its position as the largest of the three markets, but its growth has far outstripped that of access control and intruder alarm. In 2006, the breakdown of the total IBC(s) systems market is a whopping contribution of 66% by CCTV/video surveillance, 18% attributed to access control and 16% for intruder alarm. However, the penetration of IBC(s) in China based on sales per capita is only 6% of the EU(7) average and therefore there is enormous potential for growth. In 2018 when we forecast it will become the largest market in the world it will still only have a penetration of 25% of the world’s most developed markets.

Demand Drivers

The main demand drivers have been increased output of new building construction, particularly in the commercial and industrial sectors, rising crime and fear of crime, not least as a result of the massive migrant workforce. The introduction, as part of the Government’s 11th five year plan, of public security programs such as the Safe City Scheme (SCS), has given a mammoth boost to the sales of security systems, particularly in the area of CCTV/video public surveillance but it is also aimed at intruder alarms and its influence on the entire security market will continue to grow as the project is rolled out.

Chinese Manufactures

The electronic security business in China is, therefore, bristling with opportunity and the last five years has seen the emergence of several Chinese manufactures, particularly in the area of digital video surveillance technology, who have now established leading market positions. At the same time, all the world’s major players are active in the market and fighting to carve out a solid position. Most have found it difficult to establish a firm commercial base and have been frustrated by barriers, which are now coming down as measures to implement WTO membership are introduced. Their considerable effort is now starting to be rewarded as the market continues to expand at unprecedented rates and the playing field starts to level off, providing new strategic options to develop their business, including buying into established Chinese companies.

A Chartered Mechanical and Energy Engineer, Allan McHale completed an engineering apprenticeship with Rolls-Royce Aero Engine Division. He subsequently held a number of techno commercial management posts in energy related industries before joining Sema-Metra Consulting as a senior consultant in the London office, subsequently being seconded as European Sales & Marketing Director to a major American Corporation. In 1980 McHale formed ProPlan (www.proplan.co.uk), now a division of i&i limited (www.iandi.ltd.uk), to provide market intelligence to manufacturers of intelligent infrastructures for buildings.

For more information, please send your e-mails to swm@infothe.com.

ⓒ2007 www.SecurityWorldMag.com. All rights reserved.

|